In our previous exploration of Bitcoin’s scaling landscape, we looked at Lightning as a network of express couriers, and Ark as a public railway system that efficiently batches users onto a shared train. Lightning focuses on moving value from point A to point B by updating balances, while Ark focuses on concentrating as many users as possible on a single point. But there is a third way to scale Bitcoin, one that involves no routing, no batching, and surprisingly, no movement at all. This is the logic of Statechains: instead of moving the bitcoin to a new owner, we simply move the ownership of the bitcoin.

To understand this, we have to let go of the idea of "sending" money and start thinking about "re-keying" a vault.

The Re-Keyable Vault

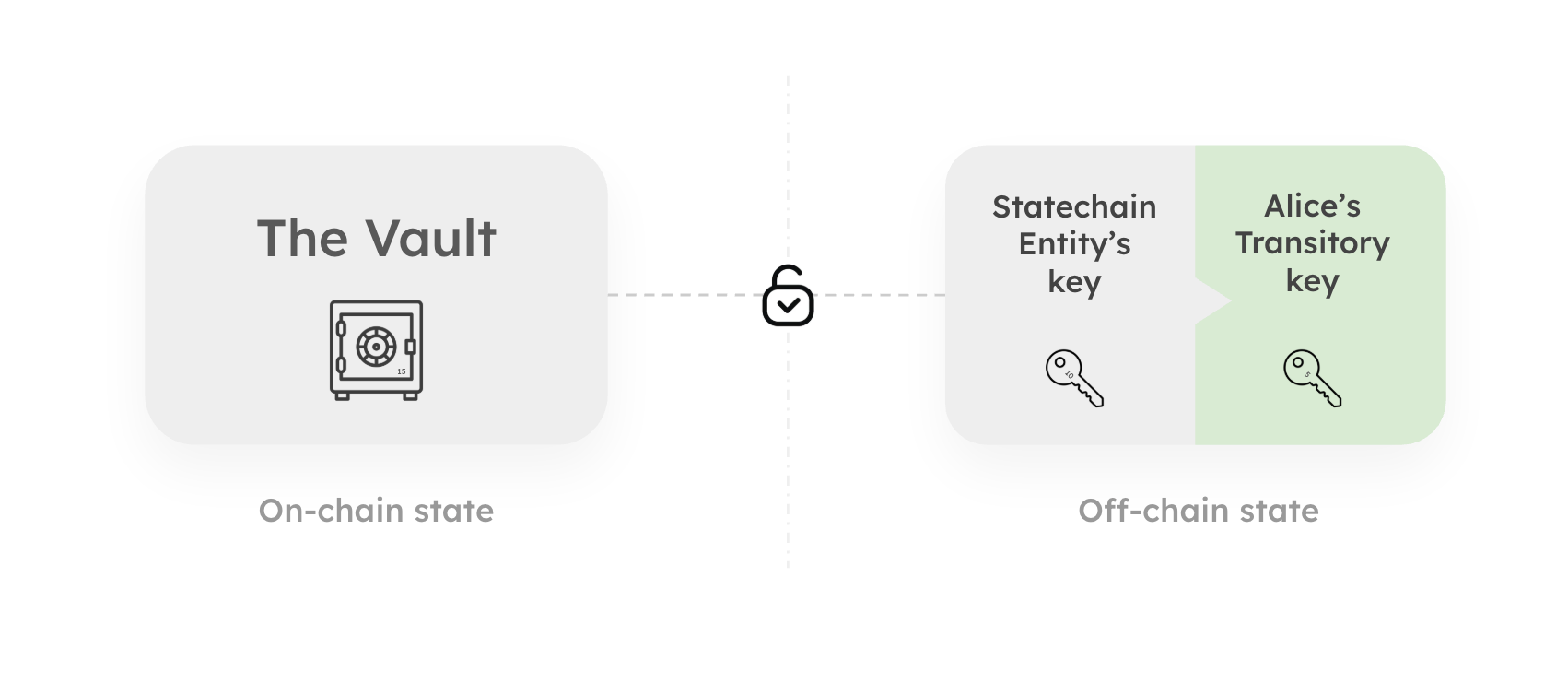

Imagine a high-tech transparent vault sitting in a public square. Inside is a bar of gold, or better yet, some bitcoin. Everyone can see it, and everyone knows exactly where it is. This vault has a unique security feature: it has no physical keyhole. Instead, it opens only when it receives a specific digital signal constructed from two separate mathematical fragments. One fragment is held by Alice, the owner (imagine this is you). The other fragment is held by the Statechain Entity (a neutral operator), much like a safe-deposit box where your bank holds one key while you hold the other one. Neither of you can open the vault alone. The Entity is not a custodian; they cannot run away with the bitcoin because they lack Alice’s fragment. Alice, conversely, cannot spend the money on the main Bitcoin blockchain without the Entity co-signing Alice’s transaction. They are in a deadlock, but it is a cooperative one.

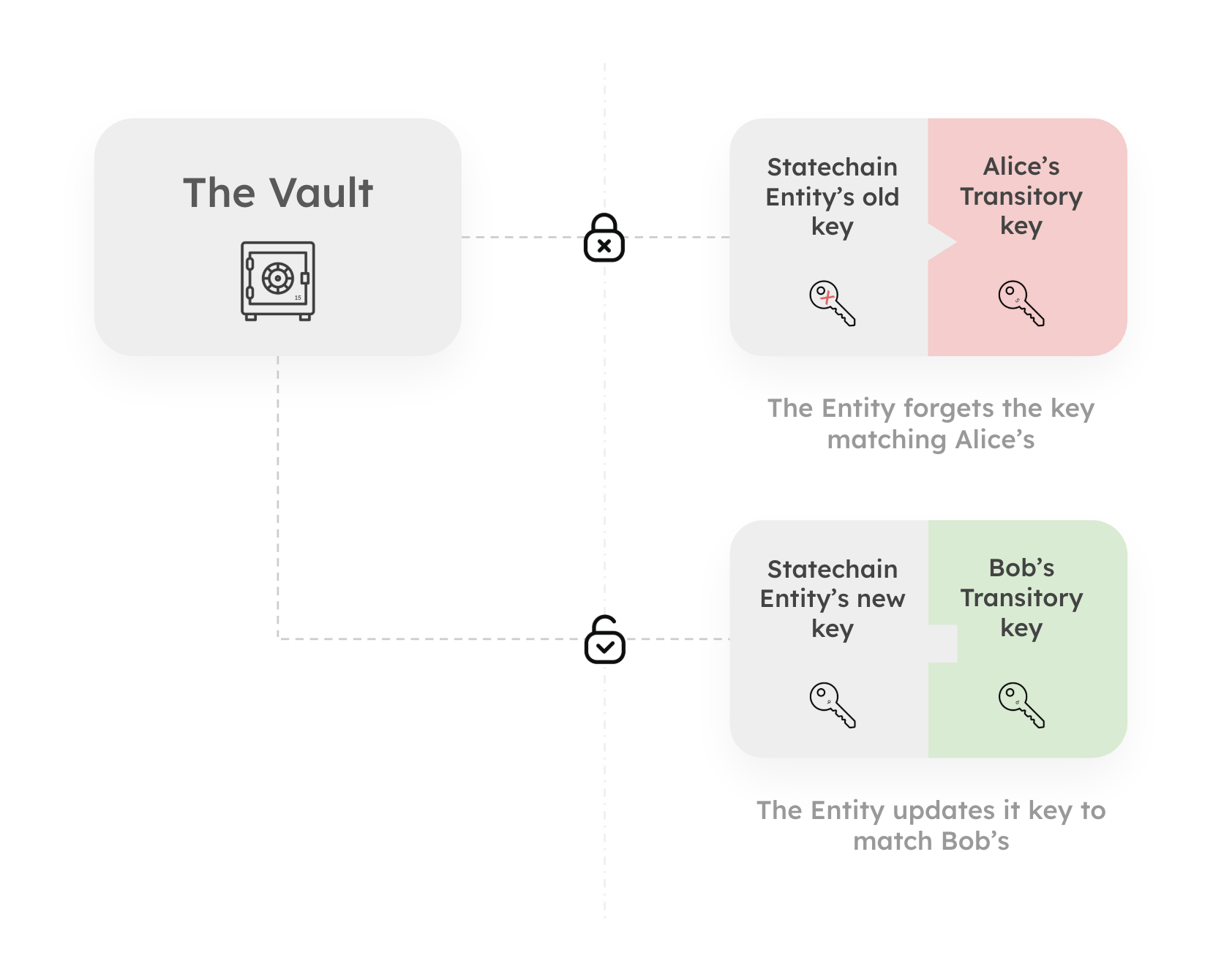

Now, imagine Alice wants to sell this bitcoin to a buyer, Bob. In a standard on-chain transaction, Alice would open the vault, take the bitcoin out, and walk it over to Bob’s vault. This is slow, expensive, and leaves a footprint. In a Statechain, the bitcoin stays exactly where it is. Instead of moving the asset, Alice and the Entity perform a "Key Rotation." Alice introduces Bob to the Entity, and together they generate a new locking mechanism for the vault that responds to Bob’s key instead of Alice’s but still needs the entity’s help to be unlocked.. Crucially, as soon as this new lock is active, the Entity deletes the fragment that matched Alice’s.

This "deletion" is the magic trick that makes Statechains work. It relies on a cryptographic concept called adaptor signatures, or simply Schnorr aggregation. Let’s say the vault is permanently programmed to open for the sum 15. To make this work, we split the "key" to the vault into two separate parts.

1. The Statechain Key: Held by the Entity (The Operator).

2. The Transitory Key: Held by Alice (The Owner).

The "Statechain Key" is the anchor. The "Transitory Key" is the ticket to ownership, it is the piece that allows anyone to move the funds. It is called "transitory" because it is designed to change hands (or change form) as ownership moves from person to person.

The Vanishing Math

Don’t worry, we will keep it simple. Let’s see how these two keys interact using our “permanently programmed to open for the sum 15” rule. Of course, the cryptographic challenge would be much harder in reality – this is just an example for illustration purposes.

1. The Setup

- Alice holds the Transitory Key: 5

- The Entity holds the Statechain Key: 10

Together (5+10), they unlock the funds (15).

2. Passing the Torch

When Alice transfers ownership to Bob, she doesn't just hand him her key (because she would still remember it!). Instead, she performs a swap.

- Bob generates a New Transitory Key (6) and he keeps this secret.

- Bob tells the Entity: "I am the new owner. Please match my key!."

3. The Adjustment

The Entity must now update its own key so the vault still opens. It effectively "re-keys" itself to match Bob.

- The Entity deletes its old Statechain Key (10) and calculates the new one (9).

4. The Result

- Bob is the new owner: His Transitory Key (6) + Entity's New Key (9) = 15.

- Alice, the previous owner, is locked out: her old Transitory Key (5) + Entity's New Key (9) = 14 fails.

The moment the Entity deletes the old instruction, Alice’s key (5) becomes useless. It’s an orphan. Alice can shout "5" at the vault all day, but without the Entity’s "10," she will never reach the old target of 15. The mathematical bridge to her ownership has been burned.

To the outside world, the vault looks untouched. The Bitcoin blockchain sees a single, static UTXO that hasn't moved. But in the private reality between the users and the Entity, the ownership has completely changed hands.

The Trust Trade-Off

If this sounds too good to be true, it’s because it comes with a specific catch. We are trading the "trustlessness" of the base layer for a trust-minimized relationship with the Entity.

We don't have to trust the Entity with our funds, they can't steal them because they never have the full key. However, we do have to trust them to be honest about the deletion. If the Entity is malicious, they could theoretically keep a copy of the old key fragment ("10") and collude with Alice to cheat Bob. This is why Statechain implementations rely on reputation and strictly sequential operations. While not perfectly trustless, it is a massive improvement over centralized exchanges.

But what if the Entity disappears? Or what if a previous owner tries to cheat? To protect users, every Statechain transfer includes a pre-signed Exit Transaction that allows the user to withdraw its funds on-chain without the Entity's help. However, this creates a potential problem: previous owners also have old Exit Transactions.

To solve this, Statechains use a Decrementing Time-Lock, think of it like a countdown clock that gets shorter for every new owner.

- Owner 1 (Alice) gets an exit ticket valid in 100 blocks (about 16 hours).

- Owner 2 (Bob) gets an exit ticket valid in 90 blocks.

- Owner 3 (Charlie) gets an exit ticket valid in 80 blocks.

If Alice (Owner 1) tries to cheat Charlie (Owner 3) by broadcasting her old exit ticket, the Bitcoin network will put her on hold because her "100 block" timer hasn't finished yet. Meanwhile, Charlie can broadcast his "80 block" ticket, which confirms first. By the time Alice's ticket becomes valid, the money is already safely in Charlie's wallet, assuming he was on the lookout and prepared for publishing his exit transaction.

This mechanism guarantees that the current owner always wins the race to the exit.

At this point you might be asking “what happens to Owner 10? What if the exit ticket reaches 0 blocks?” This should be considered as the last possible state of a Statechain, in our example, Owner 10 should be the last possible owner of the UTXO and all they can do with it now is go on-chain and create a new UTXO as the Statechain doesn’t loop.

A new tool in the Box

While the concept was originally proposed by Ruben Somsen in 2018 as a way to transfer full UTXOs, the idea is evolving. Projects like Mercury Layer are building this "transfer of full ownership" model today, allowing for the instant handover of specific coin amounts (like handing over a digital cash bill). Meanwhile, newer protocols like Spark are taking this foundation and expanding it. Spark uses the Statechain model but adds flexibility, allowing users to transfer parts of the value rather than the whole UTXO, effectively combining the "re-keying" efficiency of Statechains with the divisibility we expect from payment systems. If Lightning is the courier network and Ark is the freight train, Statechains are the deed registry. They remind us that in a digital world, moving value doesn't always require moving data. Sometimes, it’s enough to simply change the locks.

Don’t own a BitBox yet?

Keeping your crypto secure doesn't have to be hard. The BitBox hardware wallets store the private keys for your cryptocurrencies offline. So you can manage your coins safely.

Both the BitBox02 Nova and the BitBox02 also come in a Bitcoin-only edition, featuring a radically focused firmware: less code means less attack surface, which further improves your security when only storing bitcoin.

Buy the BitBox02 Nova or grab a BitBox02 in our shop!

Shift Crypto is a privately-held company based in Zurich, Switzerland. Our team of Bitcoin contributors, crypto experts, and security engineers builds products that enable customers to enjoy a stress-free journey from novice to mastery level of cryptocurrency management. The BitBox02, our second generation hardware wallet, lets users store, protect, and transact Bitcoin and other cryptocurrencies with ease — along with its software companion, the BitBoxApp!