As a trustless monetary system, Bitcoin has proven to be incredibly reliable. But this reliability comes with costs – most notably scalability. This article tries to explain how we may be finally starting to crack Bitcoin’s scalability problem with a construct called Ark, and why it matters.

Before we continue, it’s helpful to have a basic understanding of how the Bitcoin transaction model work – often referred to as the “UTXO model”, as well as multisignature wallets, to be able to grasp how different scaling concepts such as Lightning or Ark work together with the Bitcoin network.

Some context

Between 2015 and 2017, the Bitcoin community split into camps with fundamentally different ideas about how Bitcoin should scale in the future.

One camp wanted to scale Bitcoin primarily as a payment system, even if that meant sacrificing verifiability and decentralization for end users. The other camp wanted to preserve Bitcoin as a fully verifiable, trustless system, accepting lower throughput and higher on-chain fees while looking for alternative ways to scale payments, using the blockchain as a settlement layer.

This “war” has already been discussed to exhaustion. The former group – often called the big blockers – eventually forked to a new chain with a shared history: Bitcoin Cash. The latter stayed on the original “Bitcoin” chain, made backwards-compatible changes, and pursued a very different scaling strategy: Layer 2, most prominently the Lightning Network.

Explaining Lightning

To understand other Layer 2 systems, it helps to first understand Lightning, so let’s take a quick detour

At its core, Lightning is a network of peer-to-peer, vault-like multisignature contracts on Bitcoin. These contracts are connected through specialized software that allows participants to update a shared state of payments and balances off-chain, i.e. without creating transactions in the Bitcoin network for all of them. Because most activity never touches the blockchain, the system’s transaction capacity is effectively unbounded.

Lightning works, and it works extremely well for fast and cheap payments. But like many things, it comes with some trade-offs.

To use Lightning in a self-sovereign way, users must either:

- Run specialized infrastructure (a Lightning node),

- Manage inbound and outbound liquidity,

- Or trust a third party to do this on their behalf.

A middle ground emerged in the form of the Lightning Service Provider (LSP) model. Wallets like Phoenix and Breez abstract away most of the complexity by running infrastructure for users, while allowing them to still hold their own private keys. In practice, this experience can be fragile. There are simply too many moving parts, and when something breaks, it often breaks in ways users don’t intuitively understand. A major pain point of this experience is the impossibility to have the same wallet running on two devices at one.

If you want to go deeper into Lightning’s structural limitations, these are essential reads:

- Lightning Network Limitations by René Pickhardt

- Lightning Network – Fundamental Limitations by Paul Sztorc

Still, development never stopped – because Lightning is incredible for instant, low-fee payments – when it works. The problem isn’t Lightning itself, but what’s often called its last-mile problem: how do you make it usable, safe, and trust-minimized for everyday users without forcing them to run their own infrastructure and burdening them with technical details?

Introducing Ark

In the search for last-mile solutions, many ideas were proposed. One of the most promising is Ark.

Ark was introduced in 2023 and recently saw its first public implementation. Even today, Ark remains widely misunderstood – including by people deep in the industry.

At a high level, Ark can be thought of as a compression technique for Bitcoin transactions, not unlike ZIP or RAR for files. Remember those vault-like multisig contracts? With Ark, they’re no longer owned by infrastructure operators and merely used by users. Instead, they’re operated by servers but owned by users, reducing trust while also reducing complexity.

To really understand Ark, though, it helps to create the right mental model.

A mental model for Ark

Understanding Ark has proven surprisingly difficult. Even after years of discussion, many people struggle to form an accurate picture of how it actually works. Rather than diving into every technical detail, it’s more useful to start with an analogy.

Think of Bitcoin as a global logistics network – the ultimate registry where every shipment must eventually be recorded. Every package that makes it onto the ledger is guaranteed to arrive, cannot be altered, and can always be verified. This reliability is Bitcoin’s greatest strength.

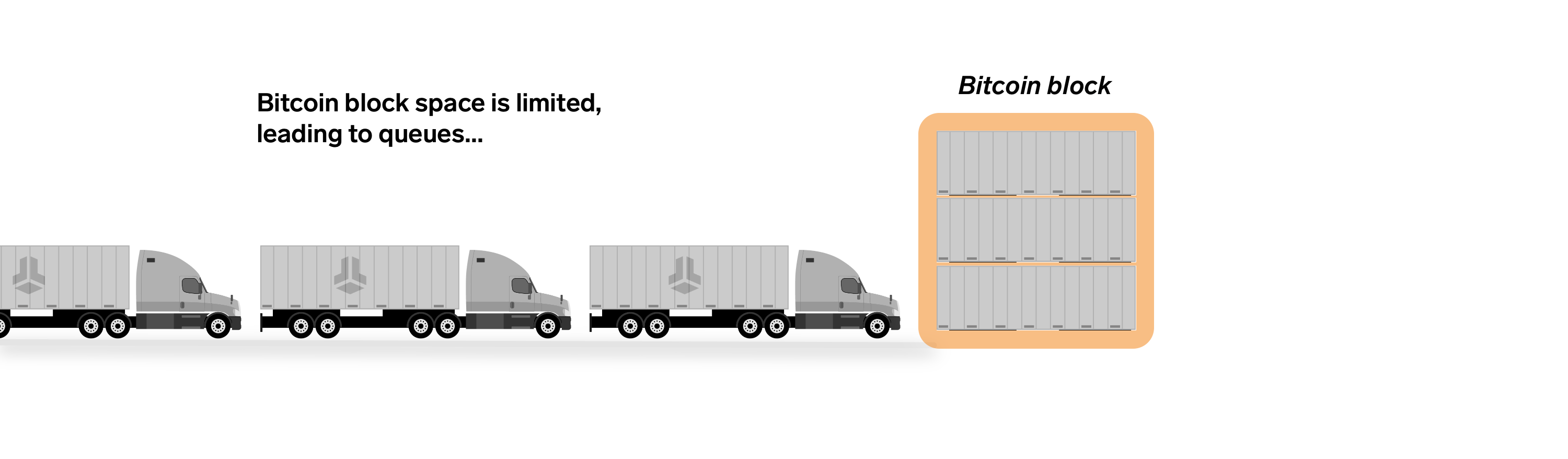

As adoption grows, more shipments arrive than can be processed at once. The system doesn’t slow down; but instead, a queue starts to build up. Anyone can pay more to jump ahead, but that in turn raises costs for everyone else. This backlog isn’t a failure – it’s a sign of success – but it clearly shows the need for more efficient transportation methods.

That’s where Layer 2 systems come in.

Lightning vs Ark: couriers and trains

Lightning is best thought of as an express courier service. It’s fast, private, and perfect for direct, point-to-point deliveries. But it requires planning: you need routes, liquidity, and coordination. If you can’t manage that, you’ll ultimately be pushed towards custodial solutions.

Ark takes a different approach. It behaves more like a public railway.

Instead of everyone needing their own delivery route, users simply board a massive train that carries countless shipments at once. Once onboard, anyone can transact with anyone else on the train instantly, without worrying about liquidity or routing.

How Ark works

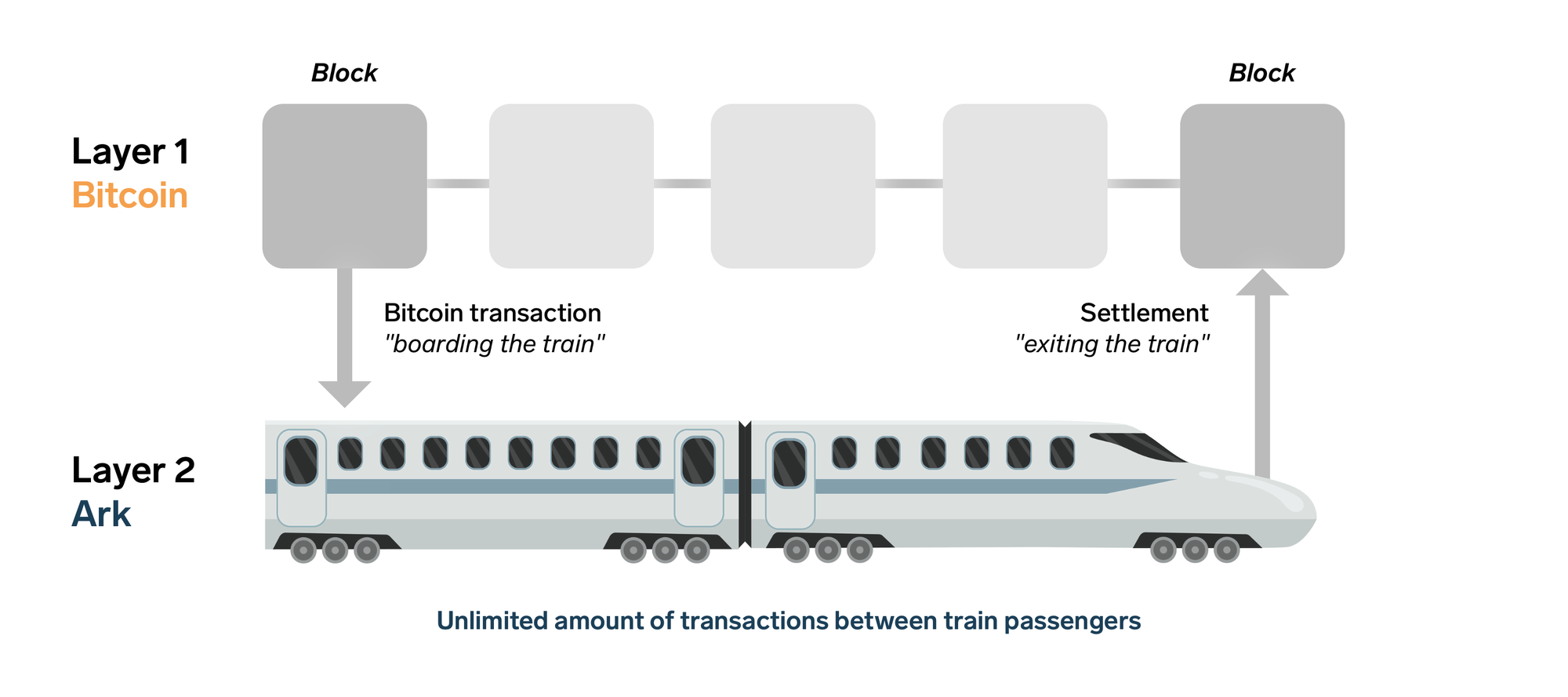

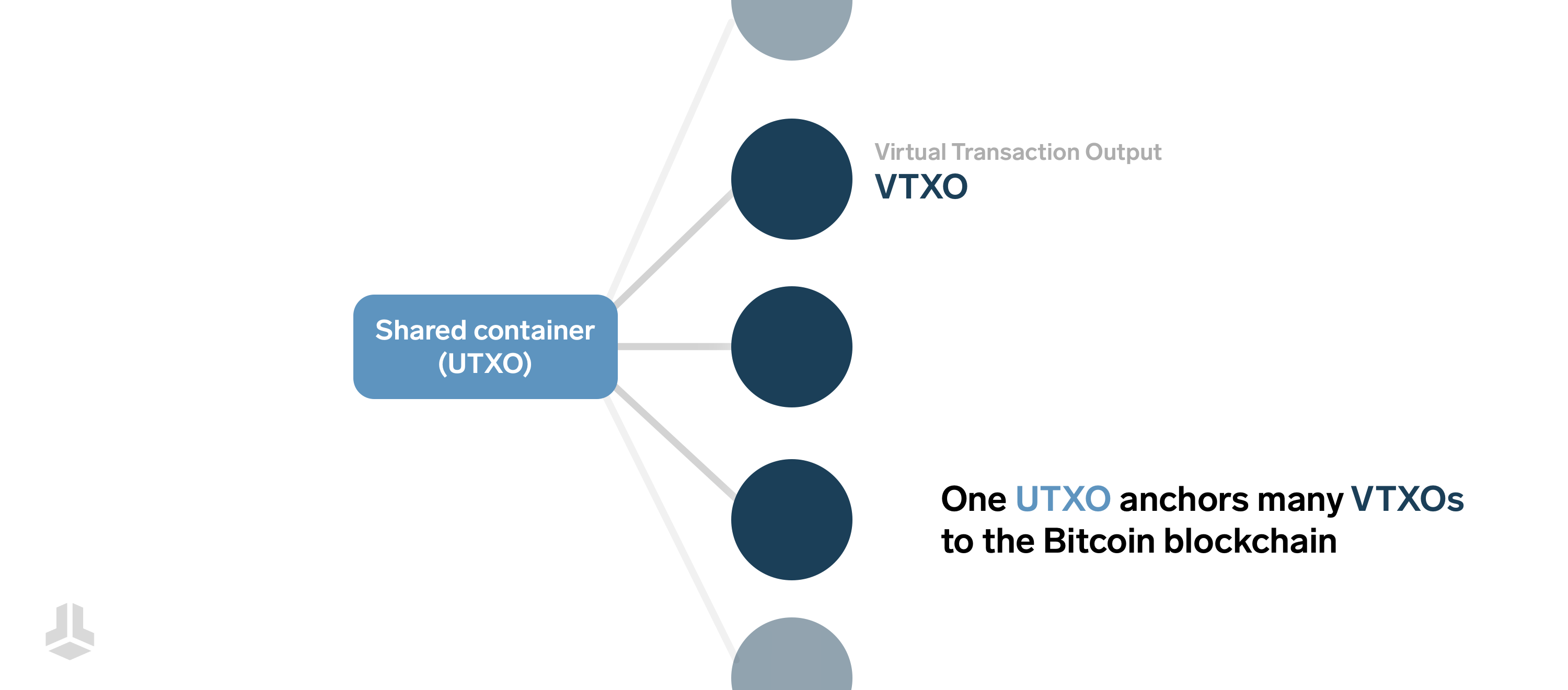

You board the Ark train by sending Bitcoin to an Ark-compatible wallet. This creates an off-chain balance called a VTXO (Virtual Transaction Output) — your personal, labeled cargo inside the train. It’s conceptually similar to a regular UTXO (Unspent Transaction Output), except that it’s not recorded on the Bitcoin blockchain (yet).

All VTXOs are collectively held in shared on-chain containers (shared UTXOs), anchoring everyone’s balances to Bitcoin. While onboard, users can transact instantly and cheaply without waiting for confirmations.

The train is coordinated by an Ark Server (also called an Ark Operator). The server helps process transactions but does not have custody over user funds. When you transact, you and the server co-sign a cryptographic contract proving the transfer occurred. These off-chain transfers are called out-of-round transactions, or preconfirmations.

Periodically, the Ark Server performs a refresh: it publishes a new snapshot of all balances to the Bitcoin blockchain, moving everyone’s VTXOs into a new shared container. Once refreshed, balances are fully finalized and publicly verifiable.

The cost of this settlement is shared among all participants, making it cheaper the more users there are. You can refresh immediately for maximum certainty, or delay if you’re comfortable relying on the operator’s honesty — the choice is always yours.

Trust, exits, and recovery

Ark introduces a unique trust model. Users rely on the operator for convenience, not for custody.

At any moment, you can:

- Unilaterally exit and reclaim your funds directly on Bitcoin

- Refresh to remove all operator risk

- Route funds via Lightning, using it as an express courier to other Ark instances or standard Lightning users

In extremely niche edge cases — such as sending funds to a faulty or unspendable output — recovery may require coordination with the operator. These scenarios are expected to be rare, but they highlight an important point: until funds are anchored on-chain, Ark prioritizes recoverability over irreversible loss.

Putting it all together

Ark will not replace Lightning. But it can complement it.

Lightning excels at fast, private, peer-to-peer payments. Ark provides shared capacity, simplicity, and a much lower barrier to entry. Together, they can form a layered system where express couriers and public railways coexist, all anchored to the same immutable registry.

Bitcoin doesn’t need a single scaling solution which solves all problems at once, if such a solution can even exist. It needs an ecosystem.

Ark is one of the strongest signals yet that we’re learning how to scale Bitcoin without sacrificing what makes it Bitcoin in the first place.

Don’t own a BitBox yet?

Keeping your crypto secure doesn't have to be hard. The BitBox hardware wallets store the private keys for your cryptocurrencies offline. So you can manage your coins safely.

Both the BitBox02 Nova and the BitBox02 also come in a Bitcoin-only edition, featuring a radically focused firmware: less code means less attack surface, which further improves your security when only storing bitcoin.

Buy the BitBox02 Nova or grab a BitBox02 in our shop!

Shift Crypto is a privately-held company based in Zurich, Switzerland. Our team of Bitcoin contributors, crypto experts, and security engineers builds products that enable customers to enjoy a stress-free journey from novice to mastery level of cryptocurrency management. The BitBox02, our second generation hardware wallet, lets users store, protect, and transact Bitcoin and other cryptocurrencies with ease — along with its software companion, the BitBoxApp!